The Comptroller’s Audit Division Ensuring Fair Taxation in Texas

Members of the Texas Comptroller’s Audit Division

The Texas Comptroller’s office collects revenue from more than 60 separate state taxes, fees and assessments — about $48.5 billion in fiscal 2016. And making sure the appropriate amounts are collected is the responsibility of the Comptroller’s Audit Division, the agency’s largest.

The Audit Division works to ensure Texas taxes are administered fairly through audits conducted as efficiently as possible and with the least inconvenience to taxpayers.

“With our taxpayers, service is important,” Audit Division Director Denise Stewart says. “We see them as our customers, and you have to take care of your customers. We conduct highly focused audits, concentrating on significant activities, and we prepare for them very carefully. We don’t want to waste taxpayers’ time or money.”

An audit doesn’t have to be adversarial, either. Comptroller auditors often help businesses identify and correct bookkeeping problems to avoid additional tax liabilities in the future.

The Audit Division also promotes tax compliance by educating taxpayers about the legal requirements for proper tax payment and reporting, reaching out through periodic seminars around the state as well as an extensive array of online resources designed to familiarize taxpayers with the process.

“We do a lot of educational activities with the companies we audit,” Stewart says. “We want to make sure they learn what’s taxable and what isn’t.”

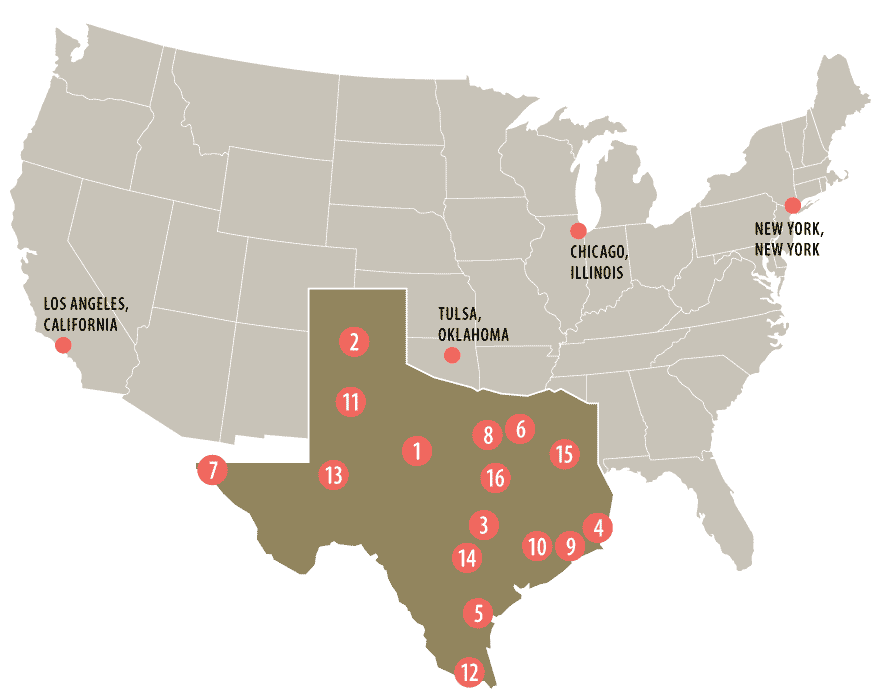

The division has more than 700 employees, including about 540 auditors, located in 18 in-state offices as well as in New York City, Los Angeles, Chicago and Tulsa (Exhibit 1); an audit review and processing center in Euless; and a headquarters in Austin.

Exhibit 1: Around the State, Across the Nation

Audit Selection

A Comptroller auditor’s main task is to determine if businesses have properly collected, reported and paid state taxes. Our auditors strive to identify tax underpayments as well as overpayments, since they sometimes discover taxes paid on tax-exempt items.

The division audits companies ranging from mom-and-pop businesses to Fortune 500 firms, using a series of specific criteria to select candidates. The state’s largest taxpayers are a common audit focus, as are taxpayers with previous audits revealing substantial amounts of tax due.

Audit candidates also may be selected based on:

- computerized random selections;

- a targeted focus on a particular type of tax or industry;

- information-sharing programs with other agencies and governments;

- analyses of tax return information;

- information drawn from business publications; and

- leads submitted to our agency by the public.

Texas taxpayers must keep all records for a minimum of four years, which is the usual period reviewed in an audit. The division may audit for longer periods if a business wasn’t permitted to operate but should have been, or if fraud has been detected.

The Audit Process

The first meeting with the taxpayer is called an entrance conference. Those under audit aren’t required to have professional representation; it’s a business decision made at the taxpayer’s discretion.

Auditors use this meeting to begin understanding the taxpayer’s practices — how they file their tax returns and maintain their financial records. The auditor generally will ask to be walked through the process, from source journals or ledgers all the way to the completion of a return.

The Comptroller’s office is authorized to examine the taxpayer’s books and records through detail, sampling or estimation. The types and condition of taxpayer records will determine the type of audit review used.

In the case of a company with relatively few transactions and more or less complete records, the auditor may review in detail, examining everything. For a large retail company, for instance, with millions of transactions, the auditor will examine a carefully selected sample of records. In the case of a taxpayer with missing or incomplete records, the auditor may develop estimates from sources such as bank records or by examining the records of a similarly situated business.

After an audit is completed, the auditor conducts an exit conference with the taxpayer, providing them with all of the items noted in the audit, including any instances of additional tax due or refundable payments made in error. The auditor attempts to answer any questions taxpayers may have and help them understand his or her findings. Taxpayers often ask our auditors how to improve their record-keeping in the future.

Finally, at the conclusion of the exit conference, the auditor sends the audit results to the division’s processing center, which reviews the audit and verifies its accuracy before sending out a bill or tax credit. The taxpayer usually receives these within a month to six weeks after the exit conference.

If a taxpayer disagrees with an audit’s findings, recourse is available through an independent audit review by the agency’s Tax Dispute Office, and then through a formal hearings process (PDF).

Valuable Commodities

A Comptroller auditor is an incredibly good investment for the state.

“Every dollar we spend on our auditors returns around $35 to $40 to the state in additional tax liabilities identified,” Stewart says (Exhibit 2).

Exhibit 2: Comptroller Audit Activity, Fiscal 2013 through Fiscal 2017 (Partial)

| Fiscal Year | Number of Audits Conducted | Tax Adjustments Identified | Dollar Amount of Refunds Denied | Total Number of Auditors | Additional Identified Tax Adjustments per Auditor | Additional Identified Tax Adjustments per Dollar Spent on Audit Staff |

|---|---|---|---|---|---|---|

| 2013 | 15,230 | $1,670,213,422 | $376,546,212 | 512 | $3,262,136 | $38.69 |

| 2014 | 15,081 | $1,970,417,402 | $773,645,262 | 536 | $3,676,152 | $43.47 |

| 2015 | 13,494 | $1,700,748,359 | $549,868,300 | 542 | $3,137,912 | $37.64 |

| 2016 | 14,503 | $1,556,192,788 | $650,634,284 | 534 | $2,914,219 | $33.44 |

| 2017 (first half)* | 6,413 | $801,919,187 | $269,357,428 | 544 | $1,474,116 | $34.39 |

* September 2016 through February 2017.

Source: Texas Comptroller of Public Accounts

Unfortunately, Comptroller auditors are also valuable to the private-sector companies that routinely “poach” our veterans.

“The depth and variety of experience our veteran auditors acquire makes them highly desirable to private companies that can pay more than we can,” Stewart says.

Turnover has been a constant problem for the division and has been very high in the past. Recent legislative funding for salaries has reduced its turnover significantly, but retaining personnel is still an ongoing struggle.

To compensate for lower auditor pay rates than those offered in the private sector, the Comptroller’s office touts the benefits of flexible hours and a generous holiday schedule, offering a better work-life balance.

Auditor Training

A Comptroller auditor isn’t made overnight. The division invests heavily in training, providing a basic program for newly hired auditors as well as ongoing advanced tax audit training for more experienced personnel.

“We begin training with basic exercises and then move them into relatively simple audits,” says Stewart. “It takes about two years for one of our auditors to complete enough training to handle complex audits.”

Continuous education is important, too; the Audit Division holds dozens of classes for its auditors each year.

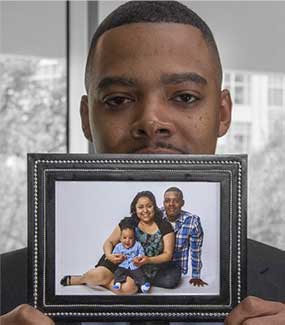

And the training isn’t all technical. According to Bill Roach, regional manager for Audit’s Houston field team, “Many people have a built-in ‘fear factor’ about auditors coming into their business. But our people are trained to be courteous and professional in dealing with taxpayers, and the vast majority of our post-audit surveys of taxpayers indicate it’s working. And while we’re in business to protect the state’s interests, we’re equally committed to processing refunds and providing taxpayer service for future compliance.”

Business Activity Research Team

In addition to field auditors, the Audit Division includes a Business Activity Research Team (BART) with offices in Austin, San Antonio and Waco. BART works with business information as well as data from other state agencies to identify and bring into compliance potential taxpayers — those without the appropriate permits — as well as underreporting taxpayers.

BART works with the Texas Workforce Commission and also uses IRS 1099s to identify non-permitted businesses that may be subject to sales and use taxes or other related taxes or fees, and informs such businesses of their tax responsibilities.

Similarly, BART uses boat and car registrations from the Texas Parks and Wildlife Department and Texas Department of Motor Vehicles to verify that the appropriate fees or taxes have been paid.

BART’s research allowed it to identify more than $104 million in additional tax liabilities in the first half of fiscal 2017.

Recently, the BART team worked with businesses in the homebuilding industry to educate them on required state tax compliance. A few hundred informational letters telling homebuilders of their use tax responsibilities brought in more than $74,000 in sales and use tax. In addition, BART research has yielded 405 voluntary disclosure agreements that raised more than $33 million in previously unreported taxes and fees in exchange for waivers on statutory penalties and interest.

The work of Comptroller auditors is painstaking and time-consuming. But it’s vital work that ensures the state’s programs can continue — and that Texas taxpayers can have confidence in a fair system. FN

Watch a video of Texas Comptroller Audit Division employees discussing what it means to serve Texans through the agency.